August Market Doldrums

We are in the historically tough stock market month of August and this year is playing out like many others. Currently there are more stocks (> 50%) in the S&P 500 below their 200-day moving average than above. That means more stocks are performing worse than the market. Difficult to know if this continues and for how long. With the US small cap stock index recently falling below its 200-day moving average and safe US bonds continuing to do well (as good as bonds can do at these low interest rate and high prices – yuck) it appears that investor’s appetite for risk is currently, and maybe temporarily, waning. I think we need some good news on tax cuts to keep the party going. Investors are getting groggy, we need another act on center stage to energize us! Who knows- maybe Janet Yellen, the head of the Federal Reserve, will throw investors more candy in the form of continued easy money when she speaks at the upcoming Jackson Hole event.

FAANG Stocks

A lot of late stage market advances have been predicated on a few popular stocks. This time it is no different, it has been the FAANG stocks (Facebook, Apple, Amazon, Netflix, and Google). The irony is that we see this time and time again. In the late stages of the tech boom it was a handful of technology stocks, in the 70’s the “Nifty Fifty” and so on.

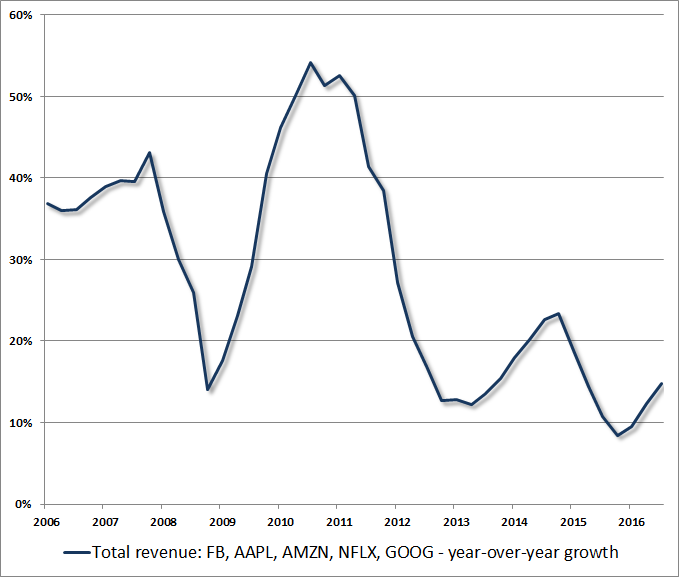

Dr. John Hussman did a great job in his commentary this week insert hyperlink noting how the growth rate of these highly successful companies (“glamour,” stocks as he calls them) naturally diminish over time. The company’s success is a big part of it as more and more people/businesses buy their products and therefore the growth rate must diminish, there is less market share to acquire. However, in late market advances, many investors bid up the price with the expectation the company’s growth rate will continue at a high rate into the future. It does become “glamorous” to own these stocks. Many of us own them even if we buy index or actively managed mutual funds because they dominate the indices, based on market capitalization. The index that contain these stocks is the S&P 500. Apple is also in the Dow Jones Industrial Average (DJIA). It amazes me that investors never learn that current company growth rates and earnings do not continue at the same high rate forever. Growth rates slow as a company matures and earnings ebb and flow the same as the economy does. Here is a chart from Hussman on revenue growth of the FAANG stocks; revenue growth is already slowing:

Market Tops

John Murphy of Stockcharts.com noted in his August 2nd Market Message that when the Dow Jones Industrial Average (DJIA – note DJIA contains only 30 large company stocks) significantly outperformed the S&P 500 (500 stocks) it has historically represented the top of the market and subsequent stock market losses. This coupled with the Dow Jones Industrial index rising while the Dow Jones Transportation index is falling is not a sign of a healthy market. The market may be in the midst of a small correction and then on to new highs. It is impossible to know. The downside is steep here so pay attention.

Game Plan

Let’s hope the party continues but remember you need a way to protect principal if you are nearing your goal. Being informed about where we are in an economic/stock market cycle is important if you will need the money in the next 10 years. If you are in a 401k, 403b, 401a or a 457 plan then you probably have limited investment options and rules against short term trading. In these accounts, take a Warren Buffet value approach. “When others are greedy (top of market) I am fearful, and when others are fearful (bottom of market) I am greedy.” Adjust you risk allocation according to the market valuation. At the top of the market you will make money, but less than if you were more aggressive. HOWEVER, you win big-time when the market adjusts downward. You then can buy bargains at the low prices moving from a conservative to aggressive approach at the proper time. If you are not encumbered by the limited investment selections and trading rules in a 401k you can be more nimble and remain aggressive here BUT you have to have a discipline to move more conservative when the market losses start to mount. There are many disciplines to follow that have a century of success- just make sure you follow the discipline.

Being a fiduciary, fee-only, CFP financial advisor we take the job seriously. We do not adhere to the blind belief “don’t worry about market losses, the market will always recover….” This statement is true historically and based on human nature should hold true again* but try to tell that to someone who loses 30% or more of their portfolio and are about to retire or send their kids to college. “Don’t worry even though you don’t have enough money for your goal. It will be ok in 10 years!” That is absolute B…S…. Sequence Risk is real. If you experience large losses at the beginning of your retirement or your kid’s college years or even approximately 10 years before, you are in trouble. There are ways to combat this but the average investor and many advisors don’t. You can make money today/this year, the market momentum has been decent most of this year which has provided nice gains. Just be smart about it, don’t be greedy if you need the money in the near term. Be nimble or smart like Warren Buffet (he recently sold a lot of GE stock at a nice profit). We work with a lot of doctors, business owners and others who have worked their butt off for decades to get to this point. We won’t get cocky and drop the ball right before they cross the goal line. We implore you to not as well.

I hope all is well with you and your family.

“If everyone is thinking alike, then no one is thinking.” – Benjamin Franklin

*Past Performance is not indicative of future results.