The Treasury Department has announced inflation-adjusted limits for 2020 retirement account savings.

IRA contribution limits remain the same for 2020.

- If you are under age 50 for the whole year, your contribution limit will be $6,000 ($500/month).

- If you are age 50 or older on 12/31/20, your contribution limit will be $7,000 ($583.33/month).

If you make workplace retirement plan contributions, read on.

SIMPLE-IRA contribution limits have increased $500 for 2020. Contact us if you need assistance calculating a per pay period deferral.

- If you are under age 50 for the whole year, your contribution limit will be $13,500.

- If you are age 50 or older on 12/31/20, your contribution limit will be $16,500.

401k / 403b / 457b contribution limits will increase $500 for 2020.

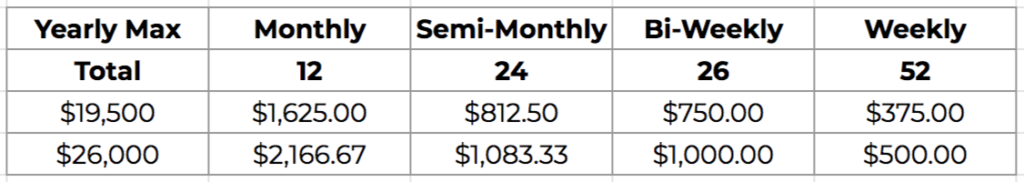

- If you are under age 50 for the whole year, your contribution limit will be $19,500.

- If you are age 50 or older on 12/31/20, your contribution limit will be $26,000.

If you contribute the maximum amount to your 401k / 403b / 457b, please make sure to adjust your 2020 contribution amount prior to your first paycheck in 2020.

We recommend that you contribute evenly throughout the year to maximize your company match (where applicable). If you maximize your contributions prior to the end of the year, you could miss out on the employer match for the remainder of the year.

To maximize your contribution for 2020, your per pay period deferral will be as follows:

(If you have any questions about your contributions, just let us know!)

At Bartley Financial, we care about way more than your finances. We care about the life you’re trying to live; finances are just a piece of that.

Call us anytime if you need fresh ideas for your finances or help in achieving your goals. We’re happy to help.