Please note that the stock market valuation informs you of NOTHING short term. Long-term (7-10 years) it is amazingly predictive of where the market will be at the end of that timeframe. It is like knowing the answers to the test but you don’t know when they will give the test!

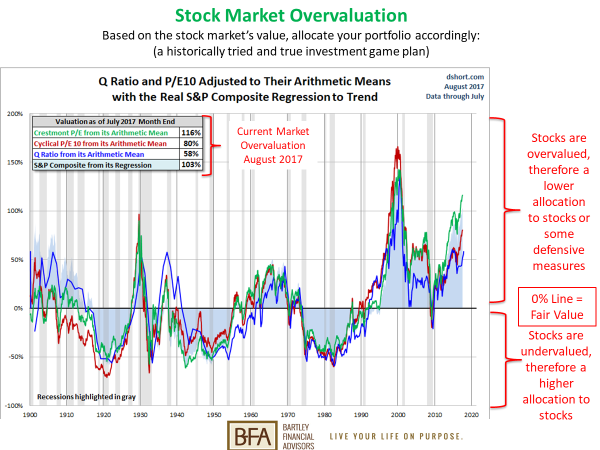

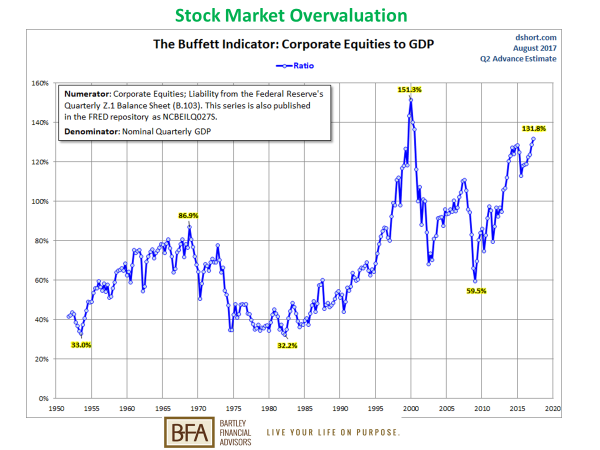

Enclosed is an update of the Stock Market Overvaluation graph (58%-116% overvalued). Please Note: Included on this graph is Robert Shiller’s Cyclical P/E 10 valuation measurement which tracks valuation back to 1871. Robert Shiller of Yale won a Nobel Prize in 2013 for his work on asset valuation. We have also included the Buffett Indicator of stock market value. Stock market valuation is the BEST indicator of future stock market performance. Therefore, the current market overvaluation requires a proactive tactical strategy for your portfolio (e.g. adjust based on value or find values and/or momentum).

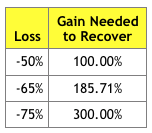

The average overvaluation is 89% on the enclosed graphs. How much and when the stock market will fall is anyone’s guess. The stock market will fall or regress to the mean; it is baked in the cake. The chart on the right provides what the gain would need to be to recover from a 50% (average bear market loss) or more stock market loss. It would require a gain of 100% or more. The key in this market is to attempt to make money but not lose your shirt. The methodologies we recommend are value and/or momentum. The goal is to protect principal but also share in the gains when an asset class (US stocks, foreign stocks, real estate, commodities, bonds, cash and others) is performing well. Your portfolio growth will be far greater if you avoid large losses so you have more money to grow when the market provides sustainable gains. This is the case even if you experience small or no gains before the market slide. I have often highlighted in quarterly reports, speeches and presentations how a portfolio that experiences large gains and large losses fares much worse than a portfolio that experiences no or nominal gains, avoids larger losses, and then shares in strong upside rallies. * I wrote more on avoiding large losses in this blog post Sequence of Returns Risk

The chart on the right provides what the gain would need to be to recover from a 50% (average bear market loss) or more stock market loss. It would require a gain of 100% or more. The key in this market is to attempt to make money but not lose your shirt. The methodologies we recommend are value and/or momentum. The goal is to protect principal but also share in the gains when an asset class (US stocks, foreign stocks, real estate, commodities, bonds, cash and others) is performing well. Your portfolio growth will be far greater if you avoid large losses so you have more money to grow when the market provides sustainable gains. This is the case even if you experience small or no gains before the market slide. I have often highlighted in quarterly reports, speeches and presentations how a portfolio that experiences large gains and large losses fares much worse than a portfolio that experiences no or nominal gains, avoids larger losses, and then shares in strong upside rallies. * I wrote more on avoiding large losses in this blog post Sequence of Returns Risk

An easy way to ascertain stock values on your own is reviewing dividend yields. The average historic dividend yield for stocks is 4+%. Currently dividend yields are less than 2% for the S&P 500 index, which tells you that stocks are greater than 50% overvalued. Low inflation and interest rates do not justify the nosebleed prices. Crestmont Research accounts for this in their P/E (Price/Earnings) stock market valuation calculation (included in the first graph below) which measures the current stock market overvaluation at 116%. Lastly the Buffett Indicator of stock market value, which measures the value of the stock market using corporate earnings and Gross Domestic Product (GDP), remains at the highest level it has been in history, other than the year 2000 peak. It is currently much higher than in 2007, before the market lost over 50% the last time.

We will continue to watch things closely for risks AND opportunities and keep you posted.

I hope all is well with you and your family.

“If everyone is thinking alike, then no one is thinking.” – Benjamin Franklin

*Past Performance is not indicative of future results.

The Buffett Value Indicator August 2017

The mean is 69.7% – currently 89% overvalued.

*Past Performance is not indicative of future results.