The Financial Crimes Enforcement Network’s (Fincen) Beneficial Ownership Information Report (BOIR) Filing Requirement

BREAKING NEWS: FEDERAL COURT IN TEXAS BLOCKS BOIR REQUIREMENT

(This means that at this time, there is no obligation to comply with the reporting requirements communicated below.)

I am writing this article to us “Average Joes” or Janes that own a small business. I will address the common questions that we have/would have.

There is a 59 page FAQ document that you probably don’t want to read! The FAQ document dives into many complex corporate ownership situations. I will not address that complexity here to avoid confusion and muddying the waters of a very simple process.

Why do we have to report who the beneficial owners are of our company? Because Big Brother said so! But seriously, a lot of shenanigans happen with shell corporations that are difficult to ascertain who the real owners are. Some of that has been reported in recent years around famous politicians. One would hope that this reporting will help in those cases, we will see. As is common in public life, the famous saying; rules for thee but not for me!

This is a ONE-TIME reporting requirement.

The good news is that it is easy to file and not time consuming.

Who Must File?

Simply –

- Corporations (S or C)

- LLC’s (and LLP’s)

Note: ANY third party including a family member, attorney, CPA, tax preparer, etc. can file on your behalf

When Do You Have to File?

- If an existing business created before January 1, 2024 – By 12/31/2024

- A new business created after January 1,/2024 – 90 calendar days from inception.

Penalty for Not Filing

What if You Say “Forget That..They Have No Business Asking…” (Not worth it)

- The civil penalty is $591/day (2024 amount which will be inflation adjusted)

- If willfully violate requirements – 2 years of imprisonment and criminal penalties of up to $10,000

- This includes filing false information

Who is a “Beneficial Owner”

Simply –

- If you own 25% or more of the entity

Information needed to file (easy-peasy) – For applicant (you) and 25% or greater owners

- Company information

- Company name

- Tax Identification (this could be your Social Security # if a single member LLC)

- Address

- You/Applicant AND each Beneficial Owner*** you need to provide

- Name and Date of Birth

- Address

- Copy of driver’s license which you must take a picture of an upload

*** Please note: For estate planning purposes, there is a good chance that your personal or family revocable trust owns the shares of your corporation or LLC (if it doesn’t call me! or your trusted professional). If this is the case, my reading of the regulations is that you should report the INDIVIDUAL who is the owner of the trust – e.g. you or you and your partner. At the end of the day that is what Fincen is after, who is the individual owner, a person.

Cutting to the Chase (Most of us can get right to filing at this point)

Instructions for Filing

- Link to access the BOIR filing page

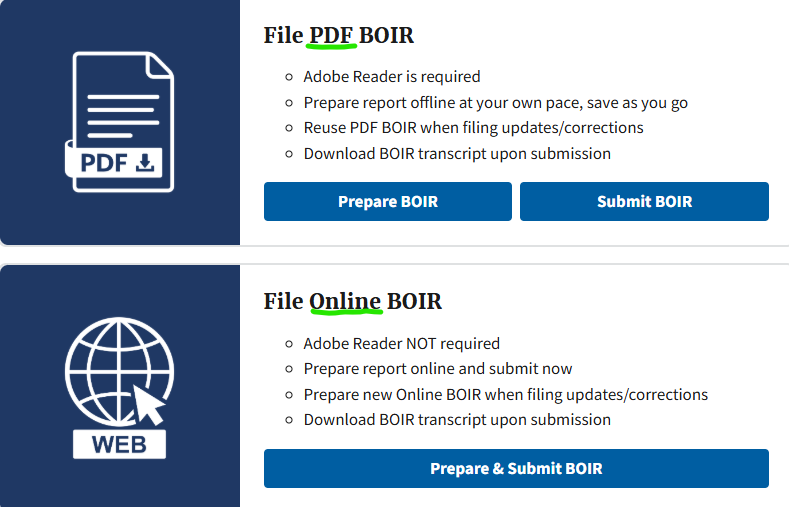

- Options are to complete a pdf or file online (see pic below)- both are supereasy

- Practical Tip – Where you have two or more filings with the same address/beneficial owner it may be easier to use the pdf option. That way you can complete all the same demographic information, save the pdf and then customize for each entity

- You then upload the completed pdfs- very quick and easy to do. You receive a confirmation from the BOIR system

- Practical Tip – Where you have two or more filings with the same address/beneficial owner it may be easier to use the pdf option. That way you can complete all the same demographic information, save the pdf and then customize for each entity

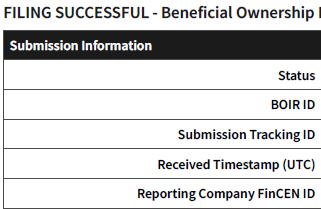

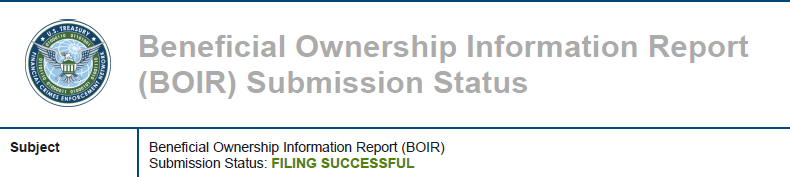

You will receive a couple things from the Fincen’s BOIR system that you should file and retain:

- Status and BOIR ID – Generated online after you submit a successful filing

- Submission Status Email – Hours or a day or so after

If you don’t have a simple situation I have included some more details below

If you have more questions here is the BOIR FAQ document

Some of the high points:

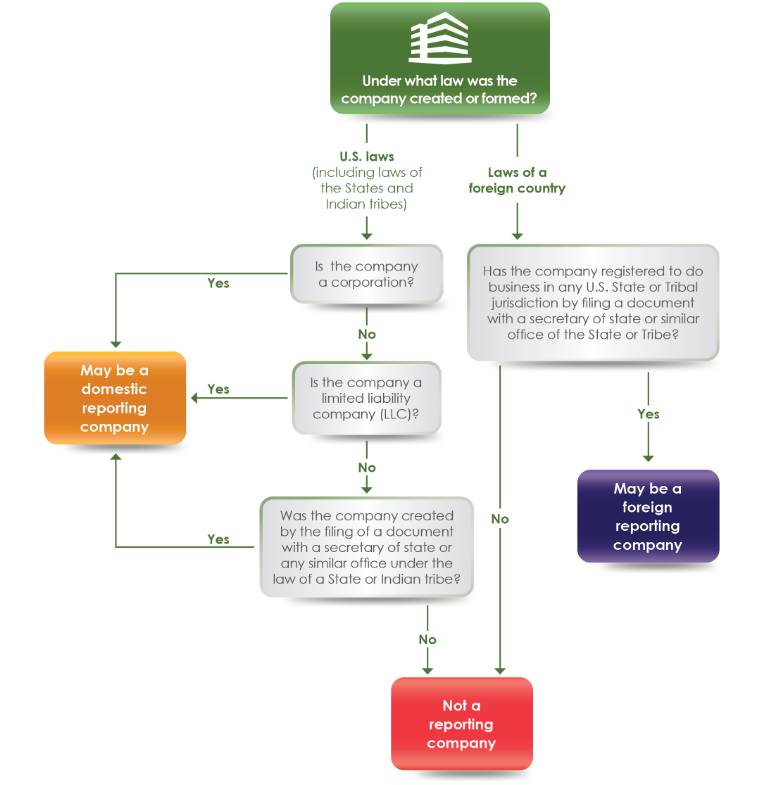

Flow Chart – Who Must Report

- Domestic reporting companies are corporations, limited liability companies, and any other entities created by the filing of a document with a secretary of state or any similar office in the United States

- There are 23 entities that are exempt from reporting. Not applicable to most business owners. The exempt companies are mostly financial industry related. The list of these 23 exempt entities are on page 9 of the FAQ pdf.

- Note: A personal trust is not required to file. The distinction is; you must file if the entity was created by filing with the secretary of state. This is not the case for personal trusts used for estate planning purposes.

- Note: A sole proprietorship does not have to report. The government already knows the beneficial owner, you!

Who is a Beneficial Owner?

- A director of a company is NOT a substantial owner if they are only a director and do not have an ownership stake of at least 25%.

Need Help?

Bartley Financial is built around a client-first ethos. We are as committed to exhibiting high levels of professionalism as we are to building relationships with clients built on trust and mutual respect. That’s why we hold ourselves to a fiduciary standard. It’s also why we offer a transparent, fee-only compensation structure so that our clients never need to be concerned about a conflict of interest.

Bartley Financial has an experienced team of CPAs and CFPs® (Certified Financial Planners®) dedicated to helping clients manage their investment portfolios, plan for retirement, strategize taxes, or execute any other initiatives in pursuit of optimum financial health and minimal financial stress. From our offices in Andover, MA, and Bedford, NH, we work to ease clients’ financial concerns, strengthen their portfolios, and assuage their worry that they don’t know what they don’t know.

Contact us today to begin a relationship with a team of knowledgeable, trustworthy professionals who put their clients first.

By Robert Bartley

Robert Bartley creates the vision for the team. Everything we do centers on the clients we are fortunate to work with. Robert always says “it’s not difficult to work hard for our clients when they are such impressive people that inspire us!” Robert is also the inspiration for BFA’s work ethic which he attributes to his parents and growing up at his family’s restaurant. Robert is always pushing the team to sharpen our skills for the benefit of our clients. He is tenacious in our collective pursuit of mastery as individuals and as a team, but understands that it is a life-long journey that is never complete.