You can have REAL tax savings if you have a better itemized deductions strategy. The 2017 Tax Cuts and Jobs Act (TCJA) nearly doubled the standard deduction for tax years 2018-2025 while eliminating personal exemptions and eliminating or restricting many itemized deductions. As a result, the percentage of taxpayers claiming itemized deductions was expected to fall sharply from about 30% in recent years to around 10% for 2018 tax filings. If you are among the millions of taxpayers affected by this change, read on for a strategy to make the most of the deductions available to you.

The Basics

The standard deduction for 2019 is $24,400 for married taxpayers filing a joint return and $12,200 for single taxpayers. Each individual age 65 or older is allowed an additional standard deduction of $1,300. Since you can deduct the greater of your itemized deductions or the standard deduction, the standard deduction can sometimes be referred to as the hurdle amount for itemizing. If the sum of your itemized deductions exceeds the standard deduction amount, you can reap a tax benefit by itemizing.

Gone for years 2018-2025 are itemized deductions for personal casualty and theft losses and miscellaneous deductions such as unreimbursed employee expenses, tax prep fees, and investment expenses. Most taxpayers will now find their itemized deductions are limited to the following items:

- Qualified medical expenses to the extent the total exceeds 10% of Adjusted Gross Income (AGI)

- The first $10,000 of state and local taxes (SALT). This includes state income or sales tax plus property taxes.

- Mortgage interest paid on acquisition indebtedness up to $750k ($1M if purchased prior to 12/16/17). Acquisition indebtedness includes loans taken out to acquire, build, or substantially improve a current residence or to refinance an existing loan that qualifies under this definition.

- The interest on a home equity loan is only deductible if you can demonstrate that the proceeds were used for a substantial improvement and not just maintenance such as a new roof.

- The interest on a home equity loan is only deductible if you can demonstrate that the proceeds were used for a substantial improvement and not just maintenance such as a new roof.

- Charitable contributions (subject to certain limits based on your AGI).

The Dilemma

With a reduced menu of itemized deductions and a higher standard deduction threshold to hurdle, many taxpayers who were previously able to itemize will find themselves left out in the cold.

The Opportunity

If you find that your itemized deductions are not high enough to hurdle the standard deduction on an annual basis, consider shifting the timing of deductions so you can lump deductions together in one year. Depending on your situation, this strategy may allow you to itemize every other year or every few years. Remember – each year that you are able to itemize means a tax savings for you!

Most categories of itemized deductions offer limited opportunities to shift expenses from one year to another.

- Medical – If you plan to itemize this year, see if you can lump medical expenses so that they exceed 10% of your AGI. Some ideas could be scheduling and paying for an elective procedure by year end or paying off the balance of your child’s orthodontia payment plan.

- SALT – If you have room under the $10k cap for state and local taxes, pay your 4th quarter state estimated tax payment prior to the end of the year or pre-pay a portion of your real estate taxes for the following year (with a caveat being that you can only claim a deduction for a future year’s real estate taxes if they have been assessed in the current year).

- Mortgage interest – Mail January’s mortgage payment early enough that it is credited to the current year in order to up your mortgage interest deduction.

The greatest opportunity for manipulating itemized deductions lies with charitable contributions since charitable contributions are discretionary as to both amount and timing.

- The basic strategy would be to increase your contributions in the years you intend to itemize and reduce or eliminate them in other years.

- If you have historically made an annual contribution and don’t want to change this pattern or you are just not prepared to pull the trigger on a large contribution by year end, there are still some options. Consider a vehicle such as a Donor Advised Fund (DAF) which allows you to contribute a lump sum now toward your future charitable goals. You get a charitable deduction for the year in which the funds are transferred to the DAF without committing the funds immediately to any charities. Using a DAF, you can set aside the amount now that you would normally donate over a period of two or more years in order to boost your itemized deductions over the standard deduction hurdle. Want to know more? See my May 24, 2019 blog post Using Donor-Advised Funds for Charitable Giving for more information about DAFs.

An Itemized Deduction Lumping Example

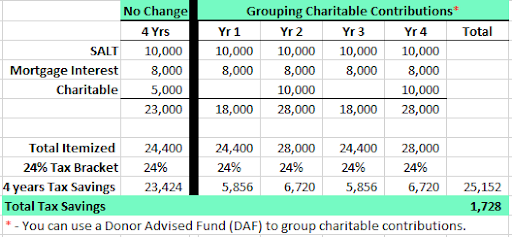

Here is an example of the power of lumping itemized deductions.

Ben and Mary have the following annual cash outlays

- $4,000 in state income taxes

- $7,000 in property taxes

- $8,000 in mortgage interest

- $5,000 in charitable donations

- $24,000 total

The above expenditures would result in total itemized deductions of $23,000 annually (the outlays total $24,000 but deductible taxes are capped at $10,000). Since the standard deduction of $24,400 is greater than the sum of their itemized deductions, they would get no benefit from itemizing.

If Ben and Mary were to double up on their charitable deduction every other year, their total itemized deductions would equal $28,000 in Year 1 and they would get an extra $3,600 deduction ($28,000 itemized – $24,400 standard deduction = $3,600) by itemizing. They would still be able to claim the standard deduction in Year 2. If they are in the 24% tax bracket, shifting their charitable contributions from Year 2 into Year 1 will save them $864 in taxes even though their cash outlay is the same. This scenario can be repeated every other year to continue to reap a tax savings. Though lumping itemized deductions can take a little planning, the potential for real tax savings can make it worthwhile!

Want Help With This Stuff?

At Bartley Financial, we care about way more than your finances. We care about the life you’re trying to live; finances are just a piece of that. Call us anytime if you need fresh ideas for your finances or help in achieving your goals. We’re happy to help!