Passed by Congress on December 23, 2022, The SECURE 2.0 Act of 2022 is an important piece of legislation aimed at expanding retirement plan coverage for the American workforce and at increasing retirement savings. It follows the SECURE Act which was enacted in 2019 with a similar purpose.

The SECURE 2.0 Act includes more than 90 provisions that impact all types of retirement savings plans. We have chosen to highlight some of the key provisions that affect individual retirement savers by effective date.

Provisions Not Yet in Effect

2025

- Part-time employees will have improved eligibility to participate in 401(k) plans. The Secure Act provided eligibility once an employee completed 500 hours of service in three (3) consecutive years. Secure 2.0 reduced the eligibility requirement to 500 hours of service in two (2) consecutive years.

- 401(k), 403(b), and 457(b) participants reaching ages 60-63 during the year are eligible to make higher catch-up contributions if allowed by their employer’s plan.

- There has been a long-standing provision allowing employees who reach age 50 by the end of the year to make “catch-up” contributions over-and-above the regular IRS maximum for the year. For 2025, the regular catch-up limit is expected to be either $7,500 or $8,000. (The official limit is an inflation-adjusted amount that is typically announced in late October or early November.)

- The higher catch-up contribution for workers reaching ages 60-63 in 2025 is projected to be either $11,250 or $12,000. It is calculated as the greater of 150% of the regular 2024 catch-up amount OR $10k (inflation adjusted).

- SIMPLE plan participants reaching ages 60-63 during the year will also be eligible for higher catch-up contributions if allowed by their employer’s plan of the greater of 150% of the regular 2025 catch-up amount OR $5k (inflation adjusted).

- The projected maximum for 2025 is at least $5,250 (compared to the regular catch up amount of at least $3,500).

2026

- Starting in 2026, rules for catch-up contributions to employer-sponsored retirement plans will depend on your earnings. If your prior-year wages were greater than $145,000 (inflation adjusted), you will only be allowed to make catch-up contributions to a designated Roth account. Those with prior-year wages below this amount can continue to make pre-tax catch-up contributions.

- If your prior-year wages exceeded the limit and your employer’s plan does not have a designated Roth account option, you will not be able to make any catch-up contributions.

- This provision was originally due to take effect in 2024, but the IRS granted a two-year reprieve to allow employers and payroll providers more time to prepare for this change.

2027

- The Retirement Saver’s Tax Credit for low income taxpayers will be replaced by a matching contribution to the taxpayer’s retirement plan.

- The contribution will be 50% of the amount contributed to a 401(k) or IRA up to $2k per individual annually.

- Eligibility phases out based on Adjusted Gross Income.

Provisions Already in Effect

Plan Years Starting after 12/29/22

- SEP-IRAs and SIMPLE-IRAs can now have designated Roth accounts.

- All or part of any employer matching contributions or employer non-elective contributions can be directed to a designated Roth account provided your employer amends its plan to allow for this provision.

- All such contributions must be treated as 100% vested when made.

- The employer contributions are included in the employee’s taxable income so the employee will be responsible for paying tax on these.

- 401(k) and 403(b) plans designed after this date must mandate automatic employee contributions equal to a predetermined percent of salary.

- The contribution rate for an employee’s first year of participation must be at least 3%, but not more than 10%.

- The contribution percentage must increase by 1% in each successive year until it reaches at least 10%, but not more than 15%.

- For plan years ending before 2025, the maximum percentage is limited to 10%.

- Employees can opt out or specify a different contribution percentage.

- Some exceptions apply for small plans, new employers, SIMPLE 401(k) plans, etc..

2023

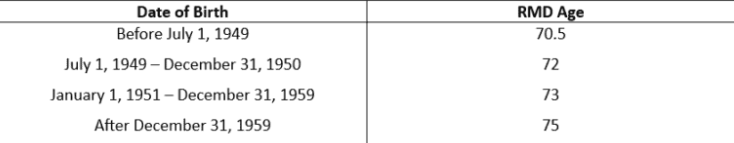

- The starting age for required minimum distributions (RMDs) from IRAs and employer-sponsored retirement plans is increased as follows:

- To age 73 starting in 2023 for those individuals turning age 72 in 2023-2032, and

- To age 75 starting in 2033 for those individuals turning age 74 after 2032.

- The penalty for failing to take an RMD is reduced from 50% to 25%.

- In addition, the penalty is further reduced to 10% if the RMD shortfall is remedied during the so-called “correction window”.

- Sole proprietors can make solo 401(k) elective deferrals by the due date of the tax return for the first plan year.

2024

- One penalty-free withdrawal of up to $1,000 is allowed annually from a tax-deferred retirement plan to cover designated emergency expenses.

- Income taxes are still due on the distribution.

- Employees have the option to recontribute the amount within a 3 year period, but can’t take any additional emergency withdrawals until repayment is made.

- Employers can offer pension-linked emergency savings accounts (PLESAs) as part of their retirement plans.

- Employers can offer the option to employees or they can automatically enroll employees with contributions up to 3% of salary.

- The contributions are after-tax and account balances are limited to $2,500.

- Funds in the ESA must be eligible for withdrawal at least once per month.

- At separation, the employee can roll the balance to a Roth account or cash it out.

- Employers can make matching contributions to a retirement plan based on qualified student loan payments made by employees.

- RMD rules no longer apply to employer-sponsored designated Roth Accounts as long as the employee lives.

- Tax-free rollovers are allowed of up to $35k (lifetime limit) from a designated beneficiary’s 529 to a Roth IRA in their name. See our June 28, 2024 blog post for additional details on this provision.

- Starter 401(k) plans can be offered by employers who do not already have retirement plans in place.

- These plans have a lower contribution limit equal to the current IRA contribution limit.

- No matching or non-elective employer contributions are allowed.

Need Help?

Bartley Financial is built around a client-first ethos. We are as committed to exhibiting high levels of professionalism as we are to building relationships with clients built on trust and mutual respect. That’s why we hold ourselves to a fiduciary standard. It’s also why we offer a transparent, fee-only compensation structure so that our clients never need to be concerned about a conflict of interest.

Bartley Financial has an experienced team of CPAs and CFPs® (Certified Financial Planners®) dedicated to helping clients manage their investment portfolios, plan for retirement, strategize taxes, or execute any other initiatives in pursuit of optimum financial health and minimal financial stress. From our offices in Andover, MA, and Bedford, NH, we work to ease clients’ financial concerns, strengthen their portfolios, and assuage their worry that they don’t know what they don’t know.

Contact us today to begin a relationship with a team of knowledgeable, trustworthy professionals who put their clients first.

By Joanne Tackes

Joanne is a Certified Public Accountant and Financial Planner on our team who believes that no financial decision should be made without knowledge of the tax consequences. Her methodical approach to financial planning leaves no stone unturned as she works diligently to provide you with a comprehensive financial plan.