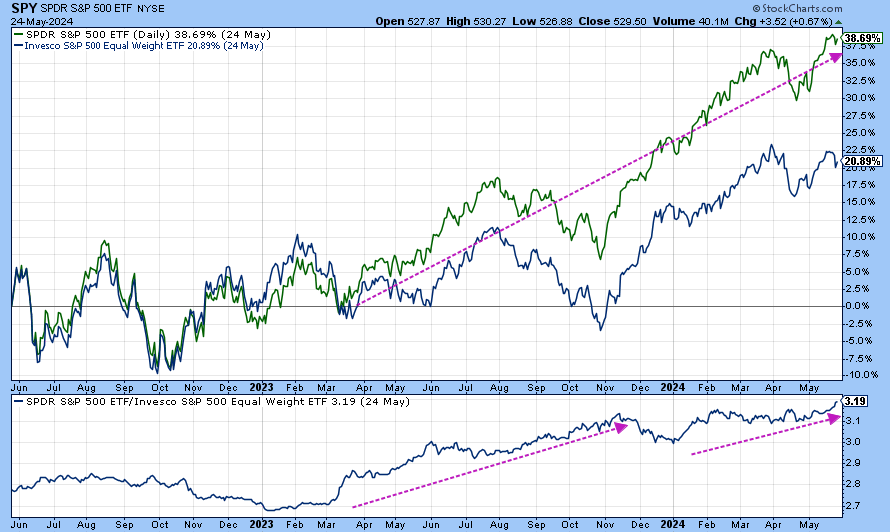

In the chart below the green line represents the capitalization weighted (based on size of company) S&P 500 index. The blue line represents the same 500 company stocks equally weighted in the index. Since early 2023 the market’s performance has been dominated by a handful of stocks, predominantly the ‘Magnificent Seven’ as highlighted in this chart by statista.

This narrowing of the performance of the stock market to a handful of stocks, generally highlights the top of a market. With that noted, this could go on for a while as it did in the late 1990’s.

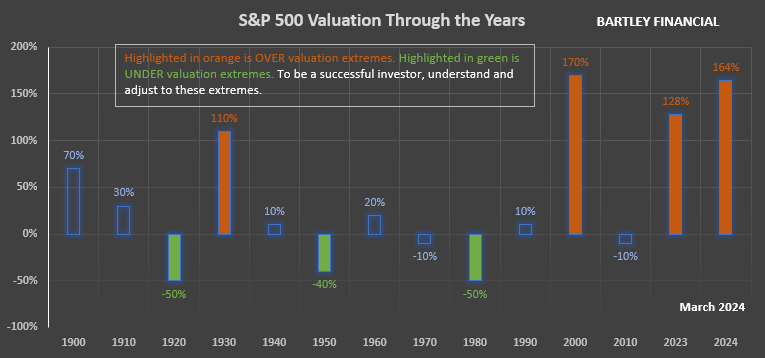

In fact the market overvaluation is just below that of the late 1990’s, the highest ever recorded. We just highlighted the overvaluation in our recent Market Valuation blog post. Based on a confluence of well respected market valuation measures (Buffet, Shiller CAPE, Q Ratio, GMO, Hussman, Crestmont Research) the market is currently 164% overvalued vs 170% in the year 2000. For comparison, the market was 110% overvalued in 1929.

As Jeremy Grantham noted in his March 19th Insightful Investor podcast:

Today is in the top percent on the Shiller P/E of all time, and when you start from this level, you have a very hard time going up materially. You’ve done it once or twice, but you’ve only done it for a while: in the last gasp of 1929; in the last gasp of 1999; and notably and most impressively in Japan, where maybe for two and a half years you kept going. And in each case, they ended incredibly badly. So, the price you paid for bucking that kind of law was a very high price….We have totally full employment, totally wonderful profit margins. All the things you would not want to start a bull market from. This is where you start bear markets from. Great bull markets start with exactly the opposite. But it always feels wonderful. Peak profit margins, getting there takes years, and it feels nice. And so you’ve got a great track record. You can’t get to peak margins without leaving a terrific track record. You’ve got the peak P/E, so you feel wonderful, the stock market has gone up and up and up and up. So everyone feels great, and that’s how you get to a market peak. You feel great about everything. Of course, almost by definition.

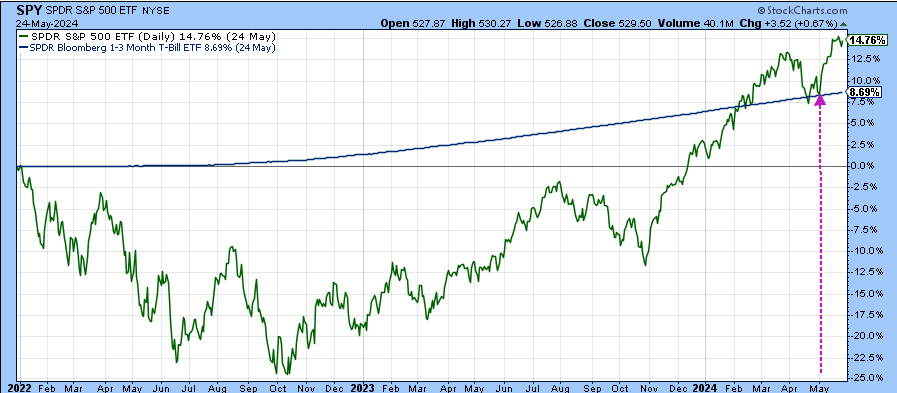

The problem is, when the market corrects and you lose your gains, it takes a long time to get back to break-even. If you are also distributing money from your account for retirement or college you could end up running out of money before the market rebounds. Basically, your compounding is all messed up (a technical term!). The chart below shows that a 1-3 month Treasury Bill outperformed the S&P 500 from January 2022 to the beginning of May 2024, after the small correction in April of this year. The haunting problem is that the 2022 correction was marginally a bear market, down only 20%. Most bear markets bring the market down more than twice that, 40% to 50+%. The last two bear markets lost 50+%. From this high market overvaluation, one would suspect we will see a market correction of 50% or more.

As Jeremy Grantham notes in the quote above, we are at the end/top of a bull market by all economic measures. This doesn’t bode well for making up the lost money in the next bear market in a reasonable amount of time.

If you are getting close to having to withdraw money from your account you want to know how to play defense. In the article Why Avoiding Large Market Downturns is Important I explain the importance of protecting principal as you near retirement or your child is nearing college.

Investors, Stay Frosty.

Need Help?

Bartley Financial is built around a client-first ethos. We are as committed to exhibiting high levels of professionalism as we are to building relationships with clients built on trust and mutual respect. That’s why we hold ourselves to a fiduciary standard. It’s also why we offer a transparent, fee-only compensation structure so that our clients never need to be concerned about a conflict of interest.

Bartley Financial has an experienced team of CPAs and CFPs® (Certified Financial Planners®) dedicated to helping clients manage their investment portfolios, plan for retirement, strategize taxes, or execute any other initiatives in pursuit of optimum financial health and minimal financial stress. From our offices in Andover, MA, and Bedford, NH, we work to ease clients’ financial concerns, strengthen their portfolios, and assuage their worry that they don’t know what they don’t know.

Contact us today to begin a relationship with a team of knowledgeable, trustworthy professionals who put their clients first.

By Robert Bartley

Robert (“Bob”) is a Certified Public Accountant (CPA) and a CERTIFIED FINANCIAL PLANNER (CFP®). He is a Summa Cum Laude graduate of Merrimack College and a Presidential Scholar. He has over 30 years of business experience and over 20 years of experience as owner of Bartley Financial.