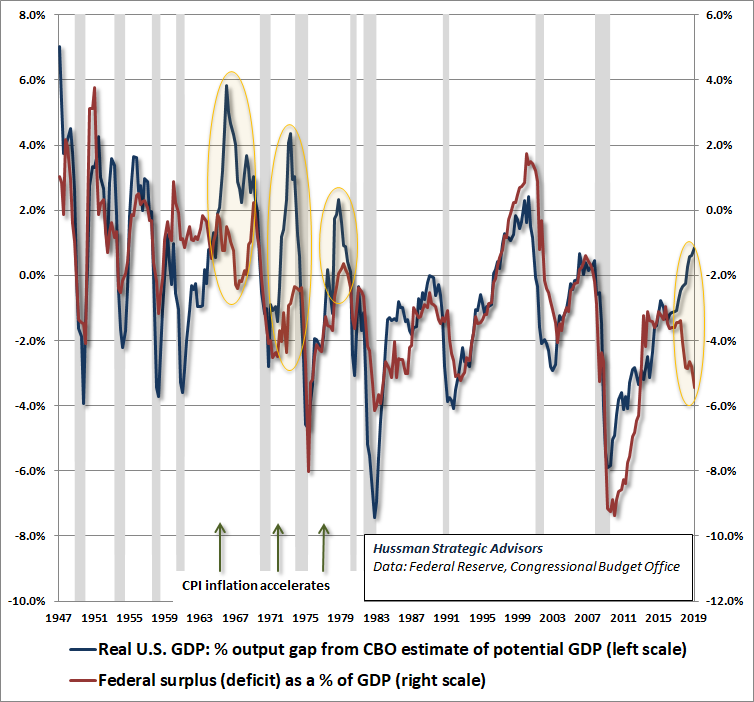

What’s the connection between government deficits and inflation? I recently wrote regarding a Wall Street Journal headline about continued trillion dollar federal government deficits. (Click here to see the post.) The graph below from Dr. John Hussman of the Hussman Funds highlights how excessive, continuous large deficits end in high inflation. Not because of the selling of bonds and printing of money to fund the deficit, but when citizens/investors lose confidence. When citizens/investors feel that the deficits are excessive and the government can’t easily pay back the money, inflation takes hold. Inflation is difficult to get back under control.

The graph below provides a picture of current and prior good economic times and high deficits (see timeframes circled in yellow). The economy growing (blue line in graph rising) while deficits rise at the same time (red line falling) has been a precursor to higher inflation. Inflation is like the stock market when investors have faith things go well but when they lose that faith, trouble is ahead.

Think of it, in good times you pay down debt and build a rainy day fund. Unfortunately, we not only don’t have a rainy day fund but we are continuing to go into debt. This will probably end ugly for current and future generations. We need to get some adults in charge in Washington (all sides of the aisle)!

Want to be prepared for the future?

At Bartley Financial, we care about way more than your finances. We care about the life you’re trying to live, finances are just a piece of that. Call us anytime if you need fresh ideas for your finances or help in achieving your goals. We’re happy to help!