What’s the COVID-19 game plan for investments? Let’s quickly look at the market, the overall economy, and take a healthy investing perspective in a time where everyone is talking about health.

The Market

The market was over its skis (overbought) after the rally from September to mid February. However, due to the COVID-19 news, the abrupt downturn in the market has now brought the market to oversold, or very close to it, depending on the technical indicator you look at, short or longer term.

The fear index is the highest in years. There will be a bounce back…but for how long? The inevitable bounce back of the markets may be short lived. We may need to retest the bottom when we find it. That is common to solidify a market bottom.

After we find bottom it is anyone’s guess where we go from there. If we were in a better economic condition with better values then it would be all-in for investing. Currently it is a market to have your defense ready.

It’s The Economy Stupid

The comment “it’s the economy stupid” made back in 1992 during President Clinton’s presidential campaign also applies to stocks. Well more accurately “it’s the earnings stupid”

The obvious issue is how much of an economic impact the virus will have. That uncertainty is playing out big time in the markets. If the economic impact will be minimal, and we get that information quickly, then the market will recover soon.

If the COVID-19 virus impacts the economy long term then the market will continue its downturn until there are signs that things are improving. However, is this the tipping point into our next recession?

Economies across the world have been slowing. We don’t see this in the States. The US economy is the cleanest dirty shirt in the global economy.

What is the main factor between a good economy and recession? Demand! Right now the demand for consumer goods is still there and will continue to be there (e.g. people want new iPhones for example) unless the economy slows to the point where there are more and more layoffs. Then, which I guess is obvious, demand diminishes. In a bad economy we spend less because we lost our job, we are worried about losing our job, our neighbor lost their job or solidarity with our fellow citizens who have lost their jobs (human nature, we feel guilty spending or worry about our own future when others are struggling).

Perspective (You Are Here)

John Hussman of Hussman Funds provided some great charts in his March 2020 commentary Make Good Choices. I thought I would share them. They provide a very good prospective of where the current market is COVID-19 disease aside.

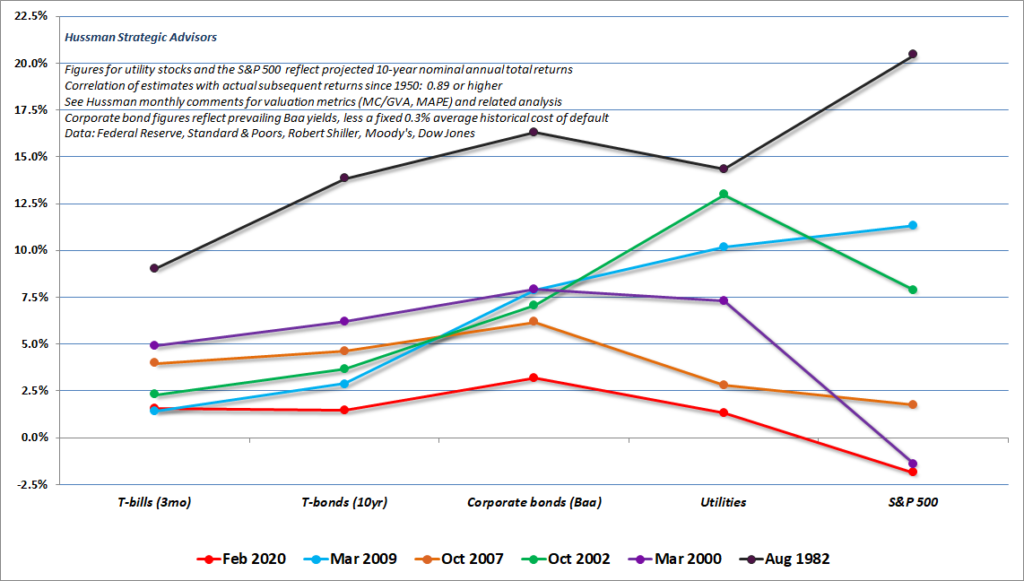

The first one below shows how overvalued ALL investments are, stocks, bonds, etc. The red line at the bottom of the graph represents the expected returns (based on current values) to expect over the next 10 years. The worst in history by far. They are all less than 2.5% other than corporate bonds which are slightly above.

I know, crazy right?! There is historical evidence to support this information. In fact the Nobel Laureate Robert Shiller was able to show that the current value of the S&P 500 index is predictive of future long-term performance. Warren Buffet’s indicator is another tool to predict future performance. We cover both in our regular Market Value Update blog posts.

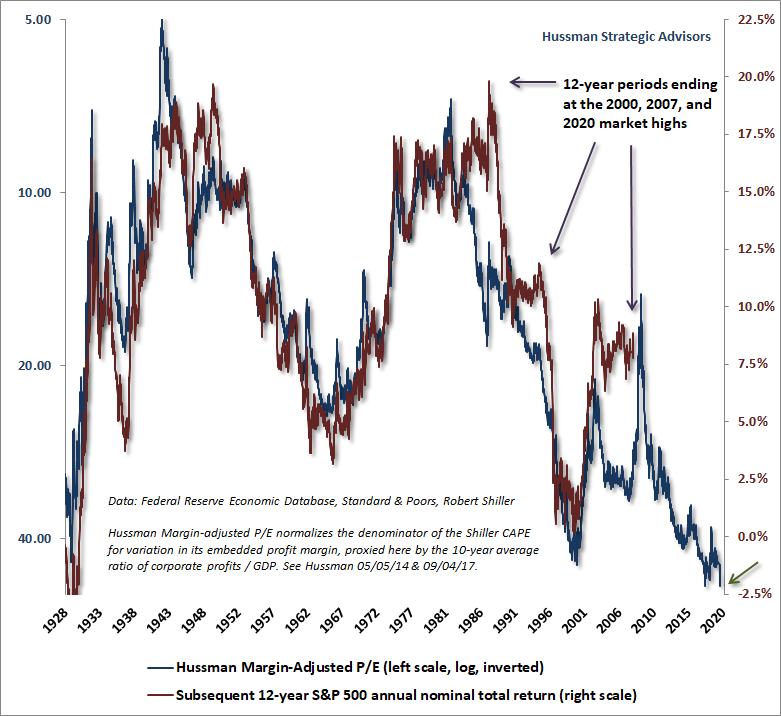

The graph above provides a picture of how predictive the current value of the market is of future returns. The market is so overvalued that the return over the next 12 years is expected to be a loss of over 2%. Again, it seems crazy. However, the math doesn’t lie. Robert Shiller’s work on asset pricing awarded him a Nobel Prize.

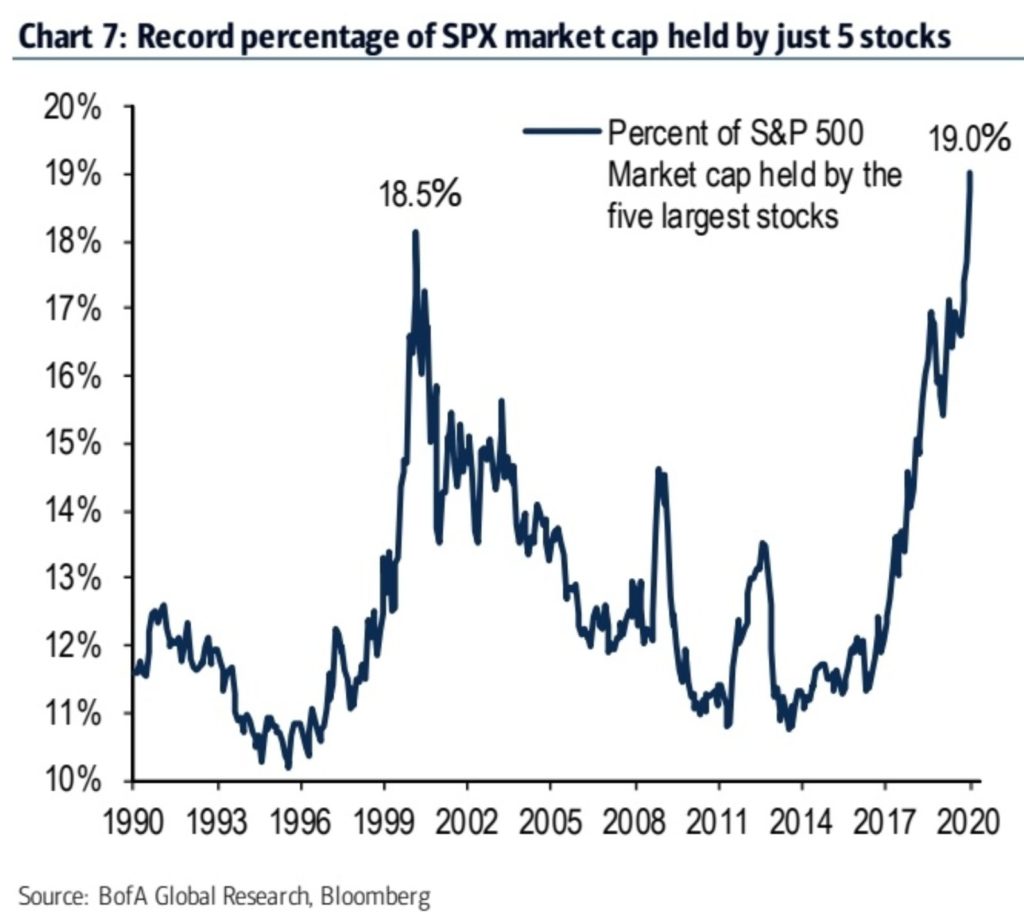

Below is another graph which I found interesting. The market advances over the past year plus have been dominated by a few stocks. The S&P 500 index (large company stocks) has been the clear winner over smaller company stocks. That is generally not the case in a strong bull market but very common at the top of a market. The S&P 500 has been dominated by the major names, the FAANG stocks. The graph below shows that the last time the S&P 500 was dominated by the top 5 stocks (based on market cap) was just before the Dot.com boom of the late 1990’s. Back in the late 1990’s the top 5 stocks were 18.5% of the S&P 500 index, now they are 19%.

Great Information…But What Do I Do With My Investment Portfolio?

If you haven’t already made a game plan or adjusted your portfolio due to the Market’s Overvaluation, damn, get to it! What are you waiting for?!?

Well, I know greed and fear (and motivation or lack of) will keep investors from making changes. Greed and fear are not our allies when it comes to investing. They make us do stupid stuff.

Our last Market Value Update spells out what you need to do, adjust your risk accordingly.

For those investors who like to be more involved and utilize market momentum, stick to your game plan!

That is the key for any investor. Have a plan and stick to it. That is the hardest part. In the words of Mike Tyson “everyone has a plan until they get punched in the mouth!”

If you use momentum in your investment strategy, and you like the action – then watch things closely and be more proactive. I suspect the market will be jumping around a bit in the short-term. In the long-term/for long-term investors, that tends to be just noise.

So what’s the COVID-19 game plan for investments? Buckle up…this may be a wild ride in the coming months!

We are looking forward to the opportunity! 🙂

Please don’t hesitate to contact me with any questions.

At Bartley Financial, we care about way more than your finances. We care about the life you’re trying to live; finances are just a piece of that. Call us anytime if you need fresh ideas for your finances or help in achieving your goals. We’re happy to help!