Roth IRA Accounts for Teens

We’ve all heard the key to retirement planning is to start early. How early? Let’s just say, it’s never too early! Consider the advantages of establishing a Roth Individual Retirement Account (IRA) for a teenager.

What is a Roth IRA? A Roth IRA is different from a traditional IRA. Where contributions to a traditional IRA can be tax- deductible, Roth IRA contributions are never deductible. In general, individuals with earned income can contribute to a Roth IRA to the extent of their earned income. The maximum contribution for those under age 50 is $5500 per year.

Similar to a traditional IRA, earnings in a Roth IRA account are not taxed when earned. The real advantage of the Roth IRA is that withdrawals in retirement are tax-free whereas withdrawals from a traditional IRA are typically taxable. The Roth IRA is often an ideal investment vehicle for younger workers. Consider a teen with limited income. She will probably not be subject to any income tax so wouldn’t derive a tax deduction from a traditional IRA contribution. It would be to her benefit to fund a Roth IRA instead so she can take advantage of tax-free distributions in retirement. Who knew that there was tax planning for teens!

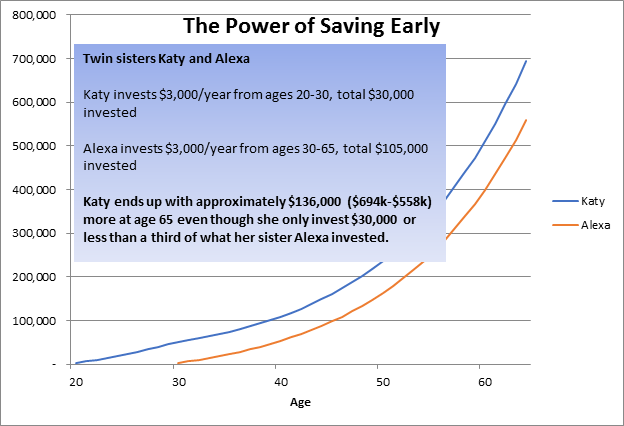

Why start so early? Teens stand to benefit more from an IRA contribution than older workers. This is because time is on their side. For a great example of the power of saving early, see the Twin Sisters graph below from our financial literacy page. Given the benefits of compounding, it’s no wonder that a 2011 Forbes article was entitled “Make Your Kid Rich With a Roth IRA”.

How does owning a Roth IRA impact education and college planning? Simply owning an IRA account will not affect the student’s financial aid eligibility. Retirement account balances are not reported as assets on the Free Application for Federal Student Aid (FAFSA). This is true even for accounts in the student’s name. Many private college require a supplemental financial aid form, the CSS Profile. According to Kimberley Lankford’s Kiplinger article titled “How Roth IRAs Affect Financial –Aid Eligibility”, retirement assets are not factored into the needs analysis for the CSS profile either.

What are the limitations? Remember that a Roth IRA account is a retirement investment vehicle. You and your teen should consider the investment to be for the long haul. That being said, your child can withdraw her Roth contributions penalty-free after the account has been established for five years. Earnings withdrawn for a Roth IRA account prior to age 59 ½ are generally subject to tax and penalties. There are exceptions, however, if withdrawals are used for certain reasons such as to cover education or medical expenses.

Be wary, however, of taking distributions from the IRA before the child’s junior year of college. Distributions (whether taxed or not) are considered income of the child. Under the new FAFSA rules, the base year for a financial aid application is two years prior so distributions taken during the Junior or Senior year of college, will not impact financial aid.

How can I help? Most teens will find it difficult to part with some of their limited hard-earned income so a Roth IRA contribution can be a tough sell. While you can certainly consider funding the Roth IRA on behalf of your child, this may do little to teach the value of investing. It may be more beneficial if Mom or Dad offer to sweeten the pot with a matching contribution of some kind. Just remember that the total contribution can’t exceed the child’s earned income for the year.

A Roth IRA account may be the best financial planning tool available for your teen. It’s never too early to start saving for retirement!