Building a nest egg for retirement is the main goal of most working Americans. No one wants to run out of money after they’ve stopped working and be forced to depend on others (or the government) for subsistence. Thankfully, we have savings vehicles that provide growth and a lighter obligation when the IRS takes their cut.

If you manage to avoid depleting your nest egg in retirement, you’re going to want an efficient way to pass your remaining assets down to your heirs. Beneficiary IRAs offer some additional benefits here as they provide an easy way for your heirs to access your assets after you’re gone. But the distribution rules can be confusing, so both the owner AND beneficiary will need to understand them to avoid unnecessary taxes and penalties.

What Happens When You Inherit an IRA?

If you leave an IRA (or an employer sponsored retirement plan) to an heir, a couple of different things can happen depending on who gets the assets, and what they decide to do with them. Traditional and Roth IRAs have different tax treatment, but Uncle Sam wants his cut no matter the situation, either pay them now or pay them later. A Roth IRA can only be transferred into another Roth IRA, the same for traditional IRAs. You can’t transfer assets from a traditional IRA into a Roth IRA upon inheriting it.

Who Should I Name As My IRA Beneficiary?

Spouses get a much broader scope of options when inheriting an IRA. One option unique for spouses is to treat the inherited IRA as their own. If you are the sole beneficiary of your spouse’s IRA, you can basically treat the IRA like it’s been yours from the start. You can name your own beneficiary, let the assets grow, and begin taking distributions on your own 72nd birthday. Note that if your spouse didn’t take an RMD in the year of death, you’ll be on the hook for that, even if you have yet to reach age 72. How do RMDs Affect IRAs?

Change to the Stretch Provision

The SECURE Act made significant changes to the way beneficiaries can disperse funds from an inherited IRA. Previously, an inherited IRA could be “stretched” – meaning the beneficiary could take RMDs and stretch them over their own lifetime, reducing the tax burden on the account. This “stretch IRA” option has now been (mostly) eliminated and IRAs must be drained within 10 years for non-spousal beneficiaries.

Redefining IRA Beneficiaries and the Stretch Provision After the SECURE Act

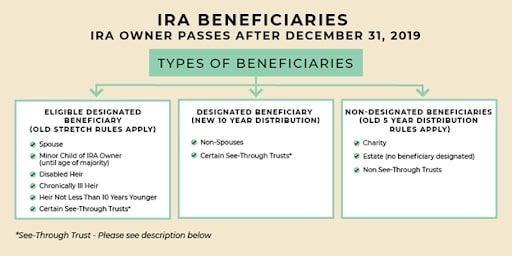

Under the new law, three different types of beneficiaries have been defined: Eligible Designated Beneficiary (stretch provision still applies), Designated Beneficiary (New 10-Year Rule), and Non-Designated Beneficiary (5-Year Rule). The category you fall under will determine whether you can still stretch your distributions or not. Note that if the original owner of the IRA passed away before 2020, the old rules on beneficiaries will still apply.

Eligible Designated Beneficiary

The SECURE Act gives the most diverse group of options to what it calls ‘Eligible Designated Beneficiaries’. The Eligible Designated Beneficiary IRA can be stretched based on the life expectancy of the beneficiary.

Under the SECURE Act, the five individuals who can be included as eligible designated beneficiaries are the surviving spouse, minor child of the original owner, a disabled person, chronically ill person, or someone not more than 10 years younger than the original owner. Certain trusts can also be labeled as eligible designated beneficiaries, but many restrictions apply.

Designated Beneficiary

If you aren’t an eligible designated beneficiary, then you likely fall under the Designated Beneficiary bracket. A designated beneficiary is anyone who doesn’t meet the qualifications for eligible statuses, such as an adult child, grandchild, nephew, or family friend more than 10 years younger than the original IRA owner or a see-through trust that clearly defines the beneficiaries.

Certain trusts can become a designated beneficiary, but generally, you must have a calculable lifespan in order to be labeled a designated beneficiary. Under this definition, the inherited IRA must be emptied within 10 years, but the beneficiary has free reign to decide how to empty the account. Spacing withdrawals over 10 years, taking two big chunks 5 years apart, or waiting until the very end and withdrawing everything in the 10th year – all these options are on the table for designated beneficiaries. Just make sure your withdrawal plan makes sense from a tax perspective.

Non-Designated Beneficiary

If no lifespan can be calculated, non-designated beneficiary status is applied. Who could inherit an IRA and not have a lifespan? It’s not who, but what. Charities, estates, and non-see through trusts fall into the category of non-designated beneficiaries. These entities have the most stringent withdrawal rules – accounts must be drained within five years, not ten.

The five-year rule only applies if the IRA owner died before age 72. If the owner died after age 72, the regular life expectancy payout rule applies. This payout rule states that the owner’s original life expectancy can be used to take RMDs from the account. Unlike the five-year rule, the beneficiary must withdraw money each year, but the account does not need to be drained within a five-year period.

The specifics of qualified trusts as beneficiaries

Qualified See-Through Trust Rules

The trust named as a beneficiary on the retirement account must meet these 4 criteria:

- The trust is valid under state law

- The trust is irrevocable or is irrevocable upon the retirement account owner’s death

- The beneficiaries of the trust are identifiable

- The trust is provided to the retirement plan trustee or IRA custodian no later than October 31st following the year of the IRA owner’s death

Consult with an Advisor Before Tapping the Account

The rules regarding beneficiary IRAs can be confusing, especially when considering the differences between the three newly defined types of beneficiaries. If you are not an Eligible Designated Beneficiary, and do not need the inherited money immediately, you have to do multi-year tax planning to calculate the lowest tax bite. For example if you will be in a higher tax bracket for two years and later in a much lower tax bracket, you should consider deferring your inherited IRA contributions until you are in a lower tax bracket.

In order to most efficiently draw down an inherited IRA, you’ll want to consult with a qualified financial advisor. An early mistake with an inherited IRA could mean a tax bill that far exceeds what you’d owe if you had taken the time to plan and weigh your options. If your predecessor took time to save and pass assets on to you, shouldn’t you at least handle them efficiently? If you stand to inherit an IRA, contact your advisor and plot a course of action.

Bartley Financial is built around a client-first ethos. We are as committed to exhibiting high levels of professionalism as we are to building relationships with clients built on trust and mutual respect. That’s why we hold ourselves to a fiduciary standard. It’s also why we offer a transparent, fee-only compensation structure, so that our clients never need to be concerned about a conflict of interest.

Bartley Financial has an experienced team of CPAs and CFPs® (Certified Financial Planners®) that help clients manage their investment portfolios, plan for retirement, strategize taxes, or execute any other initiatives in pursuit of optimum financial health and minimal financial stress. From our offices in Andover, MA and Bedford, NH, we work to ease clients’ financial concerns, strengthen their portfolios, and assuage their worry that they don’t know what they don’t know.

Contact us today to begin a relationship with a team of knowledgeable, trustworthy professionals who put their clients first.