Government deficits don’t matter, right?!? Wrong.

So it’s concerning to see our government digging an even bigger hole of national debt during the pandemic.

I heard a satirist after the last round of $600 stimulus checks note, “Americans are a funny bunch, they get excited to pay themselves checks from money they borrowed to do so!”

Pretty crazy, right?

Don’t misunderstand me, the coronavirus stimulus was absolutely necessary and saved so many people and businesses from financial ruin. I applaud the government for their actions to get money in the hands of those who needed it and will continue to need it.

But the recent stimulus programs are the tip of the iceberg. Washington has been running budget deficits in good economic times for years. And it has to stop.

If you increase deficits indiscriminately, you have less money for future social programs and other important societal needs. It may seem like we can print money forever and take care of everyone, but doing so will hurt a lot of people in a substantial way, especially future generations.

The silver lining is that many of us intuitively understand that we cannot continue to increase public debt. We have to let our government representatives know that we want to get our financial house in order, because continued stimulus and budget deficits are a recipe for economic disaster.

I’ll explain why.

Money Doesn’t Grow on Trees

The further we get away from the greatest generation that endured true suffering in the Great Depression and their forefathers that built this country, the more we will lack the understanding of what it takes to handle difficult problems – how to accept and even embrace the shared sacrifice for the betterment of the whole. As President Kennedy said in the early 1960’s, “Ask not what your country can do for you, ask what you can do for your country.”

In other words, we can’t expect easy solutions to thorny issues, just as we can’t expect other people to pull us out of a hole we have dug for ourselves – we all have to roll up our sleeves and pitch in to help ourselves and each other.

And yet, the economic theory du jour is Modern Monetary Theory or MMT, which espouses that governments can print money and disperse it to its citizens without concern for budget deficits. The proponents of MMT posit that if all this extra money causes inflation to rise, then the government can control it with taxation.

But MMT doesn’t account for two very important facts:

1) The amount of public debt that a government/society can support is not limitless.

2) Governments cannot control inflation. Interest rates and inflation are controlled by the markets.

Government’s Inability to Control Long Term Interest Rates

The government cannot support unlimited public debt because markets will demand higher interest rates on the debt when it gets too high. As the government tries to sell more debt to fund its excessive deficits, the market will require higher interest rates or investors will not purchase the debt.

This will limit the size of government debt because the money needed to service the debt becomes too high. It is the same as you or I getting into too much credit card debt. At some point, the minimum payments overtake our available monies to pay them.

But can’t the government control the long term interest rates to keep these low?

The Federal Reserve (Fed) can raise and lower short term interest rates, but that has little impact on long term interest rates – the market decides these. Long term interest rates are the rates tied to government debt, e.g. 10-30 year treasury bonds that fund the deficit.

The Federal Reserve attempts to control long term interest rates by buying treasury bonds in the secondary market. The size of the Federal Reserve bond purchases is dwarfed by all purchases by all investors. When investors want to move interest rates higher, they do. That is currently happening. Therefore, the government does not control interest rates, investors and the market do.

Government’s Inability to Control Inflation

The same holds true for inflation, the government can’t control it. So, what does control inflation? Supply and demand.

You can find a perfect example of supply and demand in the current housing market. Here’s how it works: there is a shortage of housing inventory on the market currently, whether you live in Massachusetts, New Hampshire, Florida or most other places in the United States.

At the same time, the demand has been very high to purchase homes. One source of demand is baby boomers downsizing to smaller homes and the other is younger generations reaching the prime home-buying ages. In addition, due to the pandemic and employees’ new-found ability to work from home, more buyers are bidding for the same suburban homes that are for sale in short supply. Plus, the currently low interest rates allow for lower mortgage payments, meaning more people are able to afford the small number of homes for sale.

The high demand for middle range/priced homes coupled with a low supply of these homes has significantly increased the prices. The only thing that the government can do to rectify the increasingly inflated prices of these homes is to stop buying government bonds (Quantitative Easing programs) to try to increase long term interest rates and reduce the number of people who can afford these houses. However, this has marginal effectiveness.

Putting It All Together: Supply, Demand, Inflation, and Interest Rates

Here’s another example: the Fed went on a buying spree of treasury bonds from the Great Recession through 2018, in the hope of lowering long term interest rates and increasing inflation.

Their actions did not increase inflation or measurably lower long-term interest rates. Yes, the long-term interest rates dropped. But in a way that was commensurate with other countries who’s central banks were not as “stimulative,” buying their own government bonds.

Why didn’t this impact inflation or long term rates? Because people were not borrowing all the extra cash in the banking system. Demand did not increase dramatically and there was no measurable change in supply.

Therefore, if the government cannot control supply and demand, they cannot control inflation as the proponents of MMT claim they can. They are correct that they can impact the demand side of the equation by raising taxes. Less money in the hands of business and consumers will translate into less demand. However, the government cannot control supply, nor do they have good systems in place to track supply.

The 1970’s is a great example of a supply shortage that was the catalyst to higher inflation. The oil embargo of that time significantly increased the price of oil and gas, key components in the production of goods and services and therefore price. This spike in oil prices sparked hyperinflation. The government had no control over the inflation in the 1970’s because it was the supply side that sparked it.

What Does All of This Have to Do with “Deficits Don’t Matter”?

What happens when inflation and long term interest rates rise is the cost to service the debt of the US rises due to higher interest payments. This, on top of the higher taxes already considered to reduce the deficit, which requires even more taxes to service the debt.

When you owe the money that we do as a country (note: it is our debt, not the government’s – the government is us) the interest payments to service that debt (US Treasury Bonds sold to investors) is substantial. If interest rates double, say a 30-year bond increases from an interest rate of 1.65% to 3.30%, that is double the interest on multiple trillions of dollars of debt (moving toward $30 trillion). It’s a big number that we have to come up with annually, and we don’t have the money.

Therefore, the ability of the government (collectively, us) to go into debt is not limitless. The servicing of the debt and the ability to get more of it at reasonable rates is dictated by the markets or investors. It is not controlled by the government.

Logic would tell us that most things in life are not limitless. There is an upper limit to government debt as well.

Who Will Foot the Bill for the Deficit?

The scary part is maybe the government is trying to orchestrate higher inflation. Why? Because higher inflation decreases the value of debt because you are paying the debt back with cheaper (inflated) dollars.

The problem is higher inflation will demand higher interest payments from investors. This creates a negative feedback loop. The higher interest payments require higher taxes to service the government debt payments.

These higher taxes slow the economy (less money for investment and spending to spur economic growth).

Whether or not the government succeeds in increasing inflation, everyone should expect to pay at least a portion of the bill through taxes. However, the richest among us will pay the greatest portion.

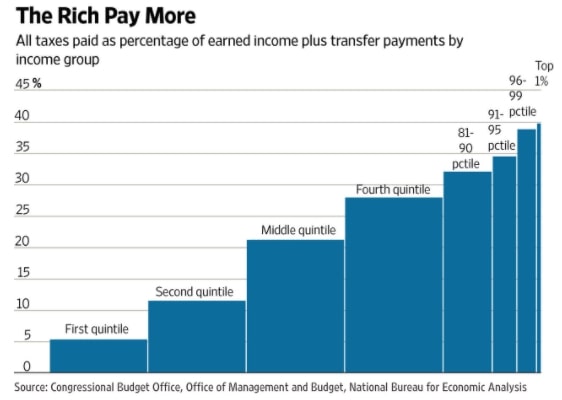

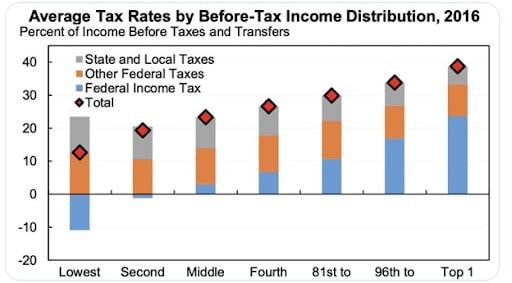

Currently, the top 1% of income earners pay approximately 40% of their income to the government. The lowest 5% earners pay less than 5% of their income to the government. These numbers represent all taxes paid including FICA tax.

The top 50% of earners pay 97% of the bill. Therefore, at least half of us are going to pay an ever-increasing amount to service all of this debt.

These articles provide evidence from the Congressional Budget Office related to who pays the bill and our portion of the tax burden: Wall Street Journal (may be behind a paywall), Money, and Tax Foundation.

The Wall Street Journal article notes that between this time last year and now, Bill Gates has reportedly given $45 billion to charity. In addition to the philanthropic motive, the contributions reduce tax liability. The article notes that we may not want to tax Bill Gates and others to the extent that it reduces their considerable charitable donations.

Through my work with non profit organizations I have found people of all walks of life to be very giving. So, I prefer that we use a carrot rather than a stick to drive public policy. Provide tax deductions for charitable giving and incentivize citizens to give, which is something they are already intrinsically motivated to do. We don’t have to take from Peter to pay Paul, we can all win if we work together.

We lack the leadership to frame the issues. We have to get out of this mentality of spending and tax. We have to balance our federal budget the same as state and local governments and we as individuals have to.

How Should the Government Stimulate the Economy?

We are all about solutions here at Bartley Financial.

If the government can’t borrow money ad infinitum, then how do you stimulate the economy in a pandemic?

Easy – target those truly in need. So much of the stimulus was not targeted to those in direct need. Certainly a portion was, which we all feel was money very well spent.

There are so many that have been economically devastated by this pandemic. That is obviously secondary to the human toll of this disaster. Providing monies for programs to support those personally impacted by the pandemic is essential. That is not an extra stimulus check to those still fully employed, or loans to businesses not impacted by the pandemic, or any other nonsense that we have to borrow money to fund.

I guess you can make an excuse for the first stimulus, the CARES Act, and how it missed a couple of key qualifiers of those in need, especially for businesses not impacted by the pandemic (it seemed obvious to me and others but what do we know). They needed to get the money out fast. I was impressed how both parties worked together with speed to push things forward. For the second two rounds of stimulus, they had plenty of time to make the programs laser focused on those in need.

Poorly allocated spending is never good. It is economic malfeasance when you borrow money and poorly allocate it. Our kids and grandkids will be paying the money back, which will diminish their ability to spend their money on what they need or desire. They will be paying for the sins or economic stupidity of prior generations.

What Else Could the Government Do to Stimulate the Economy?

In addition to assisting those directly impacted, we should have provided funds for infrastructure programs to further stimulate the economy.

Infrastructure spending stimulates the economy by funding much needed projects without the government adding permanent debt, truly a win-win. It is a government/societal investment that can allow the government to repay itself over time. A perfect example of this is the highway system constructed in the 1950s. These highways increased economic activity and tax revenue for years to come, creating growth in numerous regions throughout the country.

A more modern example of well-invested infrastructure spending could be green technology. Why not implement new technology to stimulate the economy now and provide lower energy costs for future generations?

I can’t be the only citizen that scratches my head as these folks in Washington yell at each other about all of their nonsense. Why can’t we be the leaders in the world? We could if we stopped arguing over nonsense and worked together.

In regard to the dysfunction, we have ourselves to blame, we vote them in decade after decade. We have allowed these self-serving political parties to polarize us into tribes to pit us against each other. I think/hope we are smarter than that. We are all in this together. Let’s “throw the bums out” and get people that represent us and our needs and not their own!

I apologize, I had to add the last part about Washington. Based on the current political dysfunction it is not going to do us any good to write or talk about what is the best way forward without addressing the broken system that won’t implement it.

Financial Planning and Investment Management at Bartley Financial

Bartley Financial is built around a client-first ethos. We are as committed to exhibiting high levels of professionalism as we are to building relationships with clients built on trust and mutual respect. That’s why we only offer a transparent, fee-only compensation structure so that our clients never need to be concerned about a conflict of interest.

Bartley Financial has an experienced team of CPAs and CFPs® that help clients manage their investment portfolios, plan for retirement, strategize taxes, or execute any other initiatives in pursuit of optimum financial health and minimal financial stress.

We are experienced and dedicated financial planners and investment advisors. We have experience creating comprehensive strategies to ensure that your wealth is being leveraged to move your goals closer. We execute a core and explore investment strategy that will optimize your ability to meet your goals and live the life you desire.

Contact us today to begin a relationship with a team of knowledgeable, trustworthy professionals who put their clients first.